Two claims sit side by side.

Both look routine.

One is clean and will be paid in days.

The other is missing documentation, coded incorrectly, and almost guaranteed to trigger a denial or worse, an audit.

To the human eye, they look the same until it’s too late.

That’s the problem: most billing teams only know a claim is “high risk” after it comes back denied.

By then, hours of rework are already lost, revenue is delayed, and compliance risk has grown.

But what if every claim carried a risk score before submission by flagging the problems instantly, so staff could focus where it mattered most?

That’s the shift risk scoring automation brings to healthcare billing.

What Is Claims Risk Scoring?

Claims risk scoring is the process of evaluating a healthcare claim before it’s submitted and assigning it a “risk level” based on the likelihood of denial, error, or compliance failure.

Think of it like triage for your revenue cycle, flagging what needs attention now and what’s ready to move forward.

Instead of treating every claim equally, risk scoring prioritizes the ones that are most likely to cost you time, money, or audit exposure. It uses a combination of coding rules, payer guidelines, documentation analysis, and historical patterns to predict issues in real time.

This approach changes everything for billing teams.

Instead of waiting for denials to surface issues, teams can work proactively. High-risk claims get reviewed and corrected before submission. Low-risk claims move through the pipeline faster. The result: faster reimbursement, fewer write-offs, and less staff burnout.

Why Risk Scoring Matters in 2025

The complexity of healthcare billing has exploded.

Payers are tightening rules.

Medicare is evolving constantly.

Denied claims lead to delayed care for patients.

Staff turnover has left billing teams stretched thin, often working with less experience and higher pressure.

That’s why risk scoring has become a mission-critical strategy, not just for hospitals and large systems, but for small clinics and specialty practices. It gives billing teams a clear signal: focus here, don’t waste time there.

It also gives leadership data they can act on.

If risk scoring shows a spike in issues with a particular payer, a specific service line, or one provider’s documentation, those trends can be addressed upstream, before they damage revenue.

How Risk Scoring Fits Into the Claims Lifecycle

Risk scoring happens before claims are submitted, not after they’re denied. Here’s how it fits into a standard billing workflow:

A claim is created from clinical and admin data.

The system applies payer-specific rules, coding logic, and documentation checks.

Each claim is assigned a risk score (e.g., low, medium, high).

High-risk claims are flagged for review or correction.

Clean claims move forward without delay.

This proactive layer is especially valuable for high-volume teams. No more guessing which claims might get flagged. Risk scoring automation provides clarity, accountability, and speed.

The Problem with Manual Risk Scoring

Most billing teams are already assessing risk. They’re just doing it manually, inconsistently, and often too late.

Before automation, risk scoring was essentially a gut check. Teams would review claims line by line, looking for red flags.

But in today’s high-volume, high-velocity billing environments, that approach doesn’t scale.

Manual risk scoring depends on human review, tribal knowledge, and a lot of guesswork.

The result? Risk gets missed. Clean claims get delayed.

And teams end up spending more time reacting to denials than preventing them.

Volume Overload Outpaces Human Review

The average mid-sized practice submits hundreds to thousands of claims per week. Larger systems can handle tens of thousands.

No matter how sharp or experienced your billing team is, they can’t catch every potential risk manually.

Claims are often reviewed under pressure, with deadlines, backlogs, and payer rules shifting in the background. It’s a setup that guarantees mistakes.

High-risk claims slip through the cracks. Low-risk claims get slowed down by unnecessary review. Staff burn out, and revenue gets delayed.

Inconsistent Criteria = Inconsistent Results

Risk isn’t objective when it’s managed manually. Two billers might flag the same claim differently based on their experience, attention to detail, or even the time of day. That lack of consistency creates downstream problems.

Some claims get over-reviewed and held up.

Others pass through without necessary documentation.

Patterns and systemic issues go unnoticed because there’s no unified view of where risks are appearing.

This inconsistency doesn’t just affect payment. It undermines trust in the billing process itself.

Providers don’t know why claims are getting denied.

Leadership can’t act on trends.

And billing teams are left playing defense.

Missed Red Flags Increase Audit Risk

Manual review often misses what automation would catch instantly:

Modifiers that don’t match services

Codes that don’t align with the documentation

Eligibility mismatches

Incomplete prior authorization records

Duplicate or rebilled services

Every one of these issues increases the chance of audit exposure. And every missed flag is a risk that could have been neutralized before it became a problem.

How Claims Risk Scoring Automation Works

Risk scoring automation doesn’t replace your billing team. It upgrades it.

It acts as a second set of eyes on every claim, using payer rules, logic models, and historical trends to evaluate risk in real time.

What once took hours now happens in seconds, with far greater accuracy.

At its core, automation brings consistency and scale to the review process.

It doesn’t get tired.

It doesn’t skip steps.

And it doesn’t rely on one person’s judgment to decide what should be flagged.

Let’s break it down.

1. Real-Time Analysis of Claims Data

The moment a claim is generated, the automation engine evaluates every component:

Diagnosis codes (ICD-10)

Procedure codes (CPT, HCPCS)

Documentation completeness

Payer-specific billing rules

Eligibility and authorization status

The system cross-references these elements with built-in compliance libraries, payer databases, and Medicare/Medicaid guidelines. Based on the match (or mismatch), the claim is assigned a risk score.

High-risk claims might show incomplete fields, inconsistent code combinations, or documentation that doesn’t support the services billed. Low-risk claims match exactly what the payer expects.

2. Configurable Risk Scoring Logic

Every organization is different. What’s high-risk for a cardiology clinic might not be high-risk for an outpatient physical therapy center.

Risk scoring automation lets you adjust logic based on your specialties, payers, and past audit triggers.

Examples of adjustable parameters:

Number of previous denials by claim type

Specific payers with stricter review thresholds

Service types historically associated with higher denial rates

Clinician-specific patterns (e.g., consistent missing modifiers)

This makes risk scoring not just reactive, but predictive.

3. Actionable Scoring Tiers and Flagging

Once a claim is scored, it’s categorized. Most systems use a tiered approach:

Low-risk: Auto-cleared for submission

Medium-risk: Flagged for a quick check

High-risk: Held for review and correction

This gives billing teams a clean, prioritized workflow. No more guesswork. No more sorting through hundreds of claims with no clear signal on where to focus.

4. Continuous Learning from Outcomes

Some risk scoring systems (especially AI-driven ones) improve over time. They track what happened after submission:

Was the claim paid on first pass?

Was it denied, delayed, or flagged in an audit?

Did staff need to rework the claim?

That data feeds back into the engine to refine scoring models, improve accuracy, and surface deeper insights into root causes.

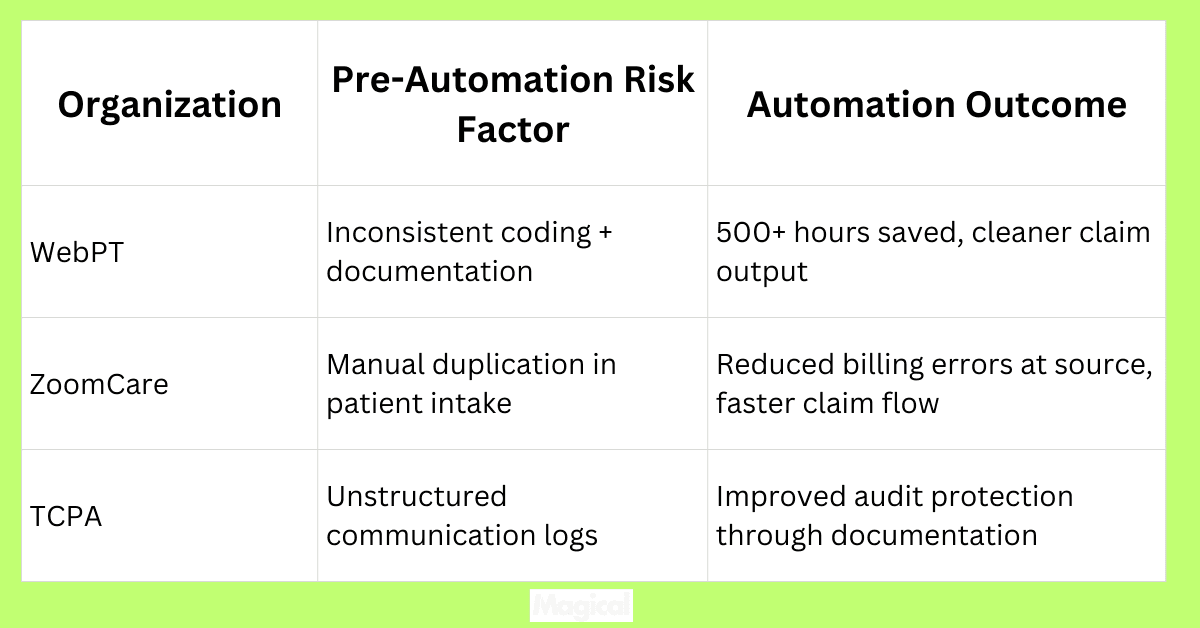

Case Studies: Real-World Impact of Risk Scoring Automation

Risk scoring automation isn’t theoretical. It’s already helping healthcare teams reduce denials, avoid audits, and protect revenue across the country.

By automating this once-manual step, organizations are gaining clarity, speed, and compliance at scale. Here’s how a few of them did it.

WebPT: From Reactive to Proactive Across 7,000 Clinics

WebPT handles millions of claims across thousands of physical therapy clinics. Before automation, error-prone documentation and repeated copy-paste tasks made it hard to identify risky claims before submission.

After integrating automation to handle repetitive entry and error checking, WebPT reduced billing inefficiencies and saved over 500 staff hours, all while improving first-pass claim approval rates.

Key Result: Fewer claim errors, faster processing, and significantly lower exposure to audit triggers.

Read the full WebPT case study

ZoomCare: Cleaner Claims at the Point of Intake

ZoomCare’s biggest challenge wasn’t billing. It was the front-end data that fed into claims. Manual duplication at the front desk introduced errors that made claims riskier and less predictable.

By automating intake and front desk workflows, ZoomCare ensured that patient data was accurate from the start. That cleaner data flowed into claims, reducing downstream rework and minimizing billing risks.

Key Result: Reduced billing errors tied to manual intake, and a clearer understanding of which claims required closer review.

TCPA: Better Communication, Better Documentation, Lower Risk

TCPA used automation to streamline patient communication, a surprising but critical part of claims integrity. Missed follow-ups or inconsistent documentation around outreach can increase risk scores, especially for Medicare patients.

By automating outreach and follow-up messaging, TCPA maintained airtight documentation across their workflows. That consistency helped protect against audits and billing disputes.

Key Result: Stronger documentation, fewer gaps in the record, and reduced risk of compliance issues tied to patient communication.

The Benefits of Risk Scoring Automation for Healthcare Teams

Risk scoring automation doesn’t just help billing teams move faster. It transforms how healthcare organizations manage revenue, compliance, and operational efficiency.

When risk is visible and prioritized upfront, everyone (from front desk to finance) feels the difference.

1. Proactive Denial Prevention

Most claim denials are preventable. They stem from small errors, missing modifiers, incomplete documentation, or misaligned payer rules.

Risk scoring automation catches those issues before the claim leaves the system.

That’s a major shift from “fix it later” to “avoid it entirely.” Instead of spending hours on rework or appeals, teams can invest that time in clean submission workflows.

Result: Fewer denials, faster payments, and less time spent on corrections.

2. Audit Readiness, Built-In

When every claim is reviewed for risk before it’s submitted, audit readiness becomes part of the workflow, not a separate, stressful process.

Automated documentation checks = fewer gaps

Risk-flagged claims are corrected before submission

Built-in logs and scoring history support audit response

Billing and compliance teams no longer scramble when audit notices arrive. The documentation is already there, already clean, already defensible.

3. Smarter Resource Allocation

Without automation, billing teams often waste time reviewing low-risk claims. Risk scoring flips that dynamic:

Clean claims flow through with little human touch

Attention is focused where it’s needed—on flagged claims

Teams work more efficiently without expanding headcount

That means more output with the same staff, and higher-value work across your billing team.

4. Visibility Into Workflow Patterns

Risk scoring systems generate analytics over time, surfacing trends in claim errors, high-risk procedures, or provider habits. This gives leadership the insights they need to:

Improve documentation training

Adjust workflows

Address systemic issues before they become revenue problems

Risk scoring doesn’t just protect revenue. It reveals opportunities to optimize it.

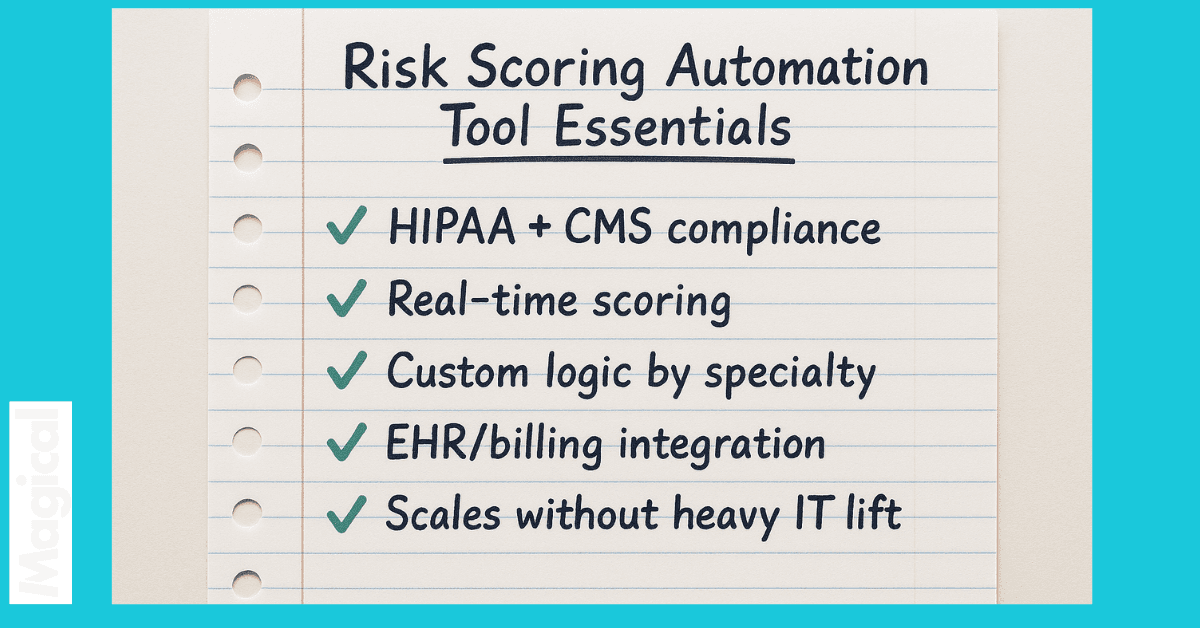

How to Choose a Claims Risk Scoring Automation Tool

Not every automation platform is built for the complexity of healthcare billing.

Some tools flag basic errors.

Others offer full integration, real-time scoring, and audit-level visibility.

The right solution should do more than check boxes. It should actively reduce risk, save time, and improve cash flow.

Here’s what to look for (and what to ask) when evaluating your options.

Must-Have Features

HIPAA + CMS Compliance: Your risk scoring tool must protect patient data and align with Medicare and Medicaid documentation requirements. Security isn’t optional—it’s foundational.

Real-Time Scoring and Error Flagging: If a tool can’t identify high-risk claims before they’re submitted, it won’t reduce denial or audit risk. Scoring must happen automatically, within the billing workflow.

Customizable Logic Based on Your Workflows: Different organizations face different risks. Look for a platform that lets you tailor rules by payer, specialty, claim type, or historical patterns.

Integration with EHR and Billing Systems: A risk scoring tool should enhance—not replace—your existing systems. No one wants to toggle between platforms or upload claims manually. Seamless integration is key.

Scalable Across Teams and Locations: Whether you’re a single-site practice or a multi-location network, your automation should work for every team without heavy IT support. (Hint: Magical does this)

Questions to Ask Vendors Before Committing

Does the tool provide real-time risk scoring during the claim generation process?

How frequently are the payer rules and logic models updated?

Can we adjust scoring parameters based on our specialties or historical claim data?

What visibility do we have into the reasons behind high-risk scores?

Can it integrate with our EHR or billing platform without custom development?

How long does onboarding take and what does staff training look like?

Choosing the right tool is about more than features. It’s about finding a solution that works in your real-world environment, with your existing team, under real billing pressure.

Final Thoughts: From Reactive Billing to Proactive Risk Control

Claims don’t have to be a guessing game. Audit exposure, denials, and compliance issues don’t need to be discovered after the fact.

With risk scoring automation, every claim is reviewed before it ever leaves your system so your team stays ahead of the problems instead of chasing them down.

It’s not about replacing human expertise. It’s about giving billing teams the visibility they’ve always needed:

What’s likely to be denied?

What’s missing?

Where are the patterns repeating?

When that insight is built into the process, revenue cycles get cleaner, audits become less threatening, and staff can focus on high-value work instead of rework.

Download the free Magical Chrome extension or book a demo for your team today! Magical is used at 100,000+ companies and by nearly 1,000,000 users to save 7 hours a week on average.